Russian economy in 2022 – new challenges affecting the window market

Since the times of the USSR, the main revenues to the country's budget have come from the sale of hydrocarbons. In recent years, their share in the country's budget has been declining, but still remains significant - about 40% of the country's GDP.

The share of energy income in 2022 decreased to 30% due to a decrease in energy exports and prices. In 2022, oil exports from Russia decreased by 16% and gas by 20%. Budget revenues from the sale of energy resources abroad have fallen sharply and will continue to decline. And this is due not only to temporary crisis factors, such as the COVID-19 pandemic, but also to the adoption by EU countries of the “Zero Emissions by 2050” program.

Decrease in Russian oil exports to the EU during the implementation of the “Zero Emissions by 2050” program 2020-2040, %

Source: Industry Center O.K.N.A. Marketing, ©oknamedia.ru

According to this program, the transition from cars with internal combustion engines (ICE) to electric motors will begin in 2025. By this period, more than 1 million battery charging stations for electric vehicles will be built in the EU countries. From 2030, EU countries will have to reduce the production of cars with diesel engines by 20%, and from 2040 – by 40%. As part of this program, it is planned to restrict the entry into countries of cars with DVZ.

Thus, the Russian Government understands that oil exports to the EU (the main consumer of Russian oil) will decrease significantly:

- after 10 years by 20%;

- in 20 years by 40%.

In 2022, the coronavirus pandemic led to a reduction in economic activity in the country, household incomes fell, and unemployment increased by 30%. Low-income citizens find themselves in the most difficult situation.

As a result, the Government has outlined the most important directions in the Russian economy.

1. The construction industry is the driver of the Russian economy

1 ruble invested in construction provides investments in related industries at the level of 4 rubles. The construction industry is considered as the basis for the development of the country's economy as a whole.

2. Support for low-income citizens, families with children and the unemployed

The second fundamental area that the authorities paid great attention to was support for families with children and the unemployed. This made it possible to maintain the purchasing power of the population, which protected against a strong fall during the crisis.

3. Gasification of the country

Russia has great demand potential for energy resources. This is due to insufficient gasification of the country's regions. Despite the constant growth of this share, the process is moving very slowly. Because of this, many territories are not only not developed, but people are leaving them, moving to more comfortable and developed regions of the country. The decline in demand for energy resources from abroad prompted the government to take more decisive action. Russian President Vladimir Putin has set the task for Gazprom to speed up the process of gasification of the country. The deterrent factors for the population in this matter are:

- overpriced gas connection;

- long process of connecting gas.

Availability of natural gas to the population of the country's regions will help “revive” these regions. There will be a demand for construction and, accordingly, for windows.

4. Energy processing

Reorientation of the hydrocarbon market to the domestic market, in addition to the supply of energy resources, also involves the creation of enterprises for their processing into final petrochemical products. This also applies to the window market. For example, in the Astrakhan region it is planned to build the largest PVC production facility in Russia*. This will not only meet the needs of the domestic market, but also reduce the ever-increasing prices for PVC resin, which will ultimately help optimize the price of plastic windows and doors.

The construction and window industries also require other products from oil refining - the production of small-scale petrochemicals. Now it is purchased abroad.

All these tasks being solved by the Government can be classified as current and future. Solving pressing problems has yielded positive results - despite the fall in economic indicators in almost all countries of the world, their decline in Russia has become less than in other countries. Based on the results of the outgoing year, the decline in the Russian economy is estimated at 3.9%, in Europe and the USA: 5-6%.

Introduction

A modern euro-window can be made of a variety of materials - plastic, aluminum or wood. Until recently, plastic was the most popular material, but new methods of wood processing have made it possible to develop laminated veneer lumber technology, which has significantly improved the quality characteristics of the wooden material.

The rapid development of the window market has also affected the wooden window sector. Now many manufacturers have switched to producing wooden windows, as a result of which their prices have decreased and they have become more accessible to a wide class.

The study of the wooden window market was conducted by the marketing research department Research.TechArt of the Tekart marketing group

.

As a result, current trends in the development of the window market were identified, the cost of a window was calculated, and the most important technical characteristics of wooden windows were analyzed. Based on the wood used, the main types of windows are identified, as well as by the types and number of sashes and glazing options. The article examines the varieties of the wooden window market, ranging from traditional Russian ones to European trends.

Construction is the most important segment of the PVC structures market

Housing construction forms 45% of the total order portfolio for the PVC structures market. The state of the construction industry thus directly affects the bottom line of the window market.

The main market share of plastic windows from construction is occupied by the following segments:

- multi-storey construction;

- low-rise construction.

Their shares among themselves in the general “Construction” segment of the PVC structures market in 2022 were distributed as follows.

Residential construction segments Russia, 2022, %

Source: Industry Center O.K.N.A. Marketing, ©oknamedia.ru

The successes of the construction industry this year have made it possible to minimize the decline in the PVC structures market.

How did the state support construction in 2022?

In 2022, despite all the difficulties largely associated with the coronavirus pandemic, the construction industry maintained a high pace. This became possible thanks to the support of the state, both in relation to the construction of multi-storey buildings and individual low-rise housing construction.

The Government's measures concerned not only supporting developers, but also creating conditions to stimulate demand for housing.

1. Multi-storey residential construction

Factors that had a positive impact on the situation in the construction industry in 2022 include the following:

Preferential mortgage at 6.5%

Preferential mortgages at 6.5% per annum for the purchase of apartments in new buildings began to operate in April 2022 and were supposed to end by November 2022. The low mortgage interest rate and the limited duration of the program provoked rush demand. This led to a significant increase in the volume of all mortgages, which became a record in the entire history of the Russian mortgage market. Over the 10 months of 2022, the volume of mortgages issued amounted to 3.25 trillion rubles, already exceeding the figures for the entire 2022, which was a record until that time. At the end of 2022, the projected volume of issued mortgages is estimated at 3.7 trillion rubles. This will be a new absolute record, exceeding the previous one (2018) by 23%, and 2019 by 30%.

Volume of mortgage loans issued and growth relative to the previous year Russia, 2015-2020, trillion rubles, % Source: Industry Center O.K.N.A. Marketing, ©oknamedia.ru

The government has decided to extend the preferential mortgage program until July 2022.

Safe purchase of new buildings

After the introduction of new rules for working in the construction of apartment buildings (MKD) - through escrow accounts, there was a lot of skepticism that this would entail an increase in prices for new buildings, a decrease in demand and the unpreparedness of participants in the process, from banks to developers, to work in new conditions. In fact, in 2022, 45% of concluded contracts for the purchase of housing in new buildings were concluded using escrow accounts.

This suggests that market participants and buyers have adapted to the new system. Future apartment owners have realized the advantages - the invested funds cannot disappear without a trace, as was the case under the old system of work. The developer will receive money for the apartments only after the building is put into operation. Thus, the equity holder’s funds are protected.

Matkapital for the purchase of new buildings

The annual population decline in Russia, largely due to insufficient birth rates, has become a serious problem for the country. The birth rate is significantly inhibited due to the lack of normal living conditions, namely, cramped living conditions. Buying more spacious housing with the birth of a child, especially for a young family, is an almost impossible task. The state is paying more and more attention to this issue. Since 2007, the country has had a Maternity Capital program - payments at the birth of children.

In 2022, the payment system is as follows:

- RUB 466,617 – at the birth of the 1st child;

- 150,000 rub. – at the birth of the 2nd child;

- 450,000 rub. - at the birth of the 3rd child.

In total, for 3 children a family can receive more than 1 million rubles, which is a significant amount, especially for the regions of Russia.

From 2022, families with 3 children can spend up to 450 thousand rubles. from maternity capital funds not only to pay off the mortgage, but also to repair existing housing, and therefore to replace old windows.

Renovation in Moscow

The Moscow construction market, due to its scale and capabilities, has a serious impact on the final performance indicators of the construction industry throughout the country. Moscow's renovation program is proceeding at a rapid pace. In place of the old five-story Khrushchev-era buildings, multi-story residential buildings are being built using the most modern technologies. They also use new window designs with high performance indicators. In addition, high quality requirements are imposed on houses under construction. All this contributes to the development of the capital’s window market, in which not only Moscow, but also regional window companies operate.

The success of the capital's renovation program is planned to be extended to the regions of the Russian Federation.

2. Low-rise residential construction

“Lessons” from the COVID-19 pandemic

The coronavirus pandemic in 2022 has changed the behavior pattern of people in the country, especially in the largest metropolitan areas - Moscow and St. Petersburg. With the introduction of restrictions, people began to actively rent countryside real estate. But the excitement in the rental housing market has provoked rising prices and a lack of acceptable options. People realized that it would be better in their home. Only your own home can be made the way you need - where you will feel comfortable and safe. Over the first 9 months of 2020, the demand for land plots on average in Russia increased by 43%. The TOP 10 regions for this indicator are shown in the diagram below.

Growth of the land market in the largest cities of Russia January-September 2022, TOP-10 regions, %Source: Industry Center O.K.N.A. Marketing, ©oknamedia.ru

"Saving" money

This year, the following negative trends were observed for the savings of Russian citizens:

- weakening of the ruble against major world currencies;

- reduction of interest on bank deposits;

- introduction of 13% income tax for deposits over 1 million rubles.

All this forced people to look for ways to invest their finances in liquid instruments, such as buying a country house.

Rural mortgage

Rural mortgages also contributed to the growth in low-rise construction. Low interest rates on loans (3%), small down payments (from 10%) have become attractive to people. This mortgage is focused on the development of regions (does not apply to Moscow, St. Petersburg and the corresponding regions) and, in particular, small villages - no more than 30 thousand inhabitants.

The development of low-rise construction supports regional window markets.

3. Construction of healthcare facilities

With the arrival of the coronavirus pandemic in Russia, it was necessary to quickly build a large number of healthcare facilities. The state allocated 40 billion rubles for these purposes, not counting the cost of equipment. The window market was faced with the task of glazing medical facilities under construction.

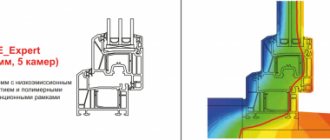

Are there any updates coming in the near future?

Our company is constantly engaged in active design work. Specialists offer improvements to existing series and create new systems that meet the most modern construction standards. Design work is underway taking into account new requirements for ASG facilities. This ensures constant demand for VIDNAL products.